Everything about Clark Wealth Partners

Getting My Clark Wealth Partners To Work

Table of ContentsThe Main Principles Of Clark Wealth Partners Unknown Facts About Clark Wealth PartnersRumored Buzz on Clark Wealth PartnersThe 6-Minute Rule for Clark Wealth PartnersClark Wealth Partners for DummiesClark Wealth Partners Can Be Fun For Everyone9 Simple Techniques For Clark Wealth PartnersSee This Report about Clark Wealth Partners

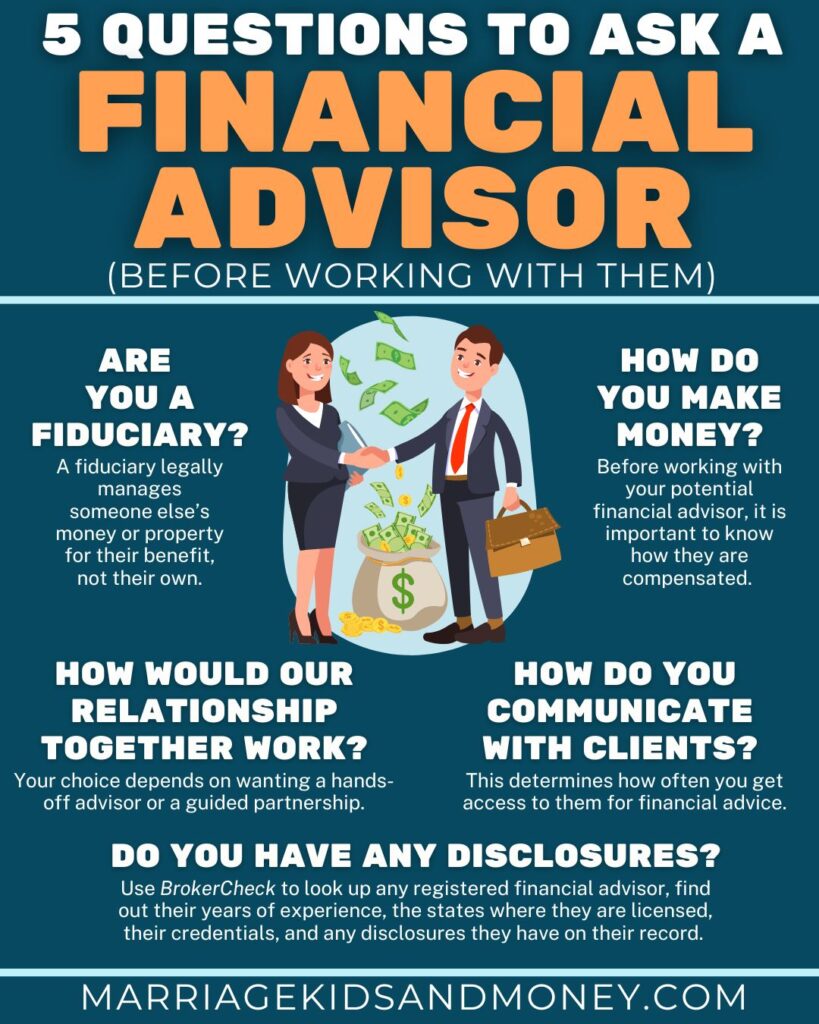

Typical factors to take into consideration a monetary expert are: If your monetary situation has become extra intricate, or you lack self-confidence in your money-managing abilities. Saving or navigating major life occasions like marriage, divorce, kids, inheritance, or work modification that may significantly influence your financial circumstance. Browsing the transition from conserving for retired life to maintaining riches throughout retired life and just how to develop a strong retired life earnings plan.New innovation has resulted in even more extensive automated financial tools, like robo-advisors. It's up to you to check out and identify the best fit - https://myxwiki.org/xwiki/bin/view/XWiki/clrkwlthprtnr?category=profile. Inevitably, a good monetary advisor needs to be as conscious of your investments as they are with their very own, avoiding excessive costs, saving cash on taxes, and being as transparent as feasible concerning your gains and losses

Clark Wealth Partners for Dummies

Earning a payment on item suggestions does not necessarily suggest your fee-based expert works versus your finest passions. Yet they may be more likely to recommend product or services on which they make a commission, which may or may not remain in your benefit. A fiduciary is legitimately bound to place their customer's passions.

This typical allows them to make recommendations for financial investments and services as long as they suit their customer's objectives, threat tolerance, and monetary circumstance. On the other hand, fiduciary advisors are legitimately obligated to act in their client's best interest rather than their own.

Excitement About Clark Wealth Partners

ExperienceTessa reported on all points investing deep-diving into complicated economic subjects, clarifying lesser-known financial investment avenues, and uncovering ways readers can function the system to their benefit. As a personal money professional in her 20s, Tessa is acutely knowledgeable about the impacts time and uncertainty have on your investment decisions.

It was a targeted ad, and it worked. Read a lot more Check out less.

Clark Wealth Partners Fundamentals Explained

There's no solitary path to becoming one, with some people beginning in banking or insurance coverage, while others start in accountancy. 1Most economic organizers start with a bachelor's level in money, economics, accounting, company, or an associated topic. A four-year level gives a solid foundation for careers in investments, budgeting, and customer service.

Clark Wealth Partners Things To Know Before You Get This

Typical instances consist of the FINRA Series 7 and Series 65 tests for safeties, or a state-issued insurance permit for offering life or health and wellness insurance policy. While credentials might not be legally required for all intending roles, employers and clients usually watch them as a benchmark of professionalism and trust. We look at optional credentials in the next area.

Most financial financial planner scott afb il organizers have 1-3 years of experience and familiarity with monetary products, conformity standards, and direct client communication. A solid instructional history is essential, yet experience demonstrates the ability to apply concept in real-world setups. Some programs integrate both, permitting you to complete coursework while making monitored hours via internships and practicums.

See This Report about Clark Wealth Partners

Numerous go into the area after functioning in banking, accountancy, or insurance policy, and the shift calls for determination, networking, and typically innovative qualifications. Very early years can bring lengthy hours, stress to build a customer base, and the requirement to continuously verify your proficiency. Still, the job supplies strong long-lasting possibility. Financial planners delight in the possibility to work closely with customers, overview crucial life decisions, and frequently attain versatility in timetables or self-employment.

Riches managers can raise their profits via payments, asset costs, and efficiency benefits. Financial managers oversee a group of monetary organizers and advisers, establishing department technique, taking care of compliance, budgeting, and guiding interior procedures. They invested much less time on the client-facing side of the sector. Almost all financial managers hold a bachelor's level, and many have an MBA or comparable graduate level.

Clark Wealth Partners - An Overview

Optional accreditations, such as the CFP, commonly require extra coursework and screening, which can extend the timeline by a number of years. According to the Bureau of Labor Data, personal economic consultants gain an average annual yearly income of $102,140, with leading earners making over $239,000.

In other provinces, there are policies that need them to meet particular needs to make use of the economic advisor or economic coordinator titles. For economic coordinators, there are 3 typical designations: Qualified, Personal and Registered Financial Planner.

The Facts About Clark Wealth Partners Revealed

Those on wage may have a reward to promote the items and solutions their employers use. Where to discover a financial advisor will certainly rely on the kind of guidance you require. These organizations have personnel that may assist you comprehend and purchase certain types of investments. For example, term deposits, guaranteed financial investment certificates (GICs) and mutual funds.